Sponsorship opportunies

Sponsorship opportunies

2024 Sponsors

Lead Sponsor

Founded by a group of industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across trading desks, risk, and compliance. That is why we pioneered the use of high-performance analytics in finance, helping the largest investment banks, asset managers and hedge funds make better decisions, explain results with confidence, and simulate the impact of their decisions.

Our mission is to deliver train-of-thought analysis on terabytes of data in the most cost-effective way so our customers can explain their results with confidence and model the scenarios that will optimize their business. We are a pure player specializing in risk data analytics for one of the fastest moving and most regulated industries with a presence in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris and Frankfurt.

For more information please visit: www.activeviam.com

Milliman is among the world’s largest providers of actuarial, risk management, and related technology and data solutions. With over 60 offices around the globe, our consulting and advanced analytics capabilities encompass the fields of healthcare, property and casualty insurance, life insurance, financial services, and employee benefits. Our breadth of expertise and data solutions provide insight into the interplay between physical, health, and economic risks, as well as the ability to communicate those risks and inform key decisions for governments, communities, and businesses around the world.

ServiceNow provides cloud-based platforms and solutions that help digitise and unify organisations so they can find smarter, faster and better ways of working, and employees and customers can be more connected, innovative and agile.

Panel Sponsors

AuditBoard is the leading cloud-based platform transforming audit, risk, compliance, and ESG management. More than 40% of the Fortune 500 leverage AuditBoard to move their businesses forward with greater clarity and agility. AuditBoard is top-rated by customers on G2, Capterra, and Gartner Peer Insights, and was recently ranked for the fifth year in a row as one of the fastest-growing technology companies in North America by Deloitte. To learn more, visit: AuditBoard.com.

At EY, we share a single focus — to build a better financial services industry, one that is stronger, fairer and more sustainable.

Our strength lies in the proven power of our people and technology, and the possibilities that arise when they converge to reframe the future.

Our professionals are dedicated to the industry, and live and breathe financial services. This deep sector knowledge combined with a holistic point of view, delivers true value from strategy through to implementation. Whether your business challenge is specific, complex, small or large, we can be trusted to deliver solutions that work for today and tomorrow.

By using technology as a tool, to transform what a business can be, and people can do, we are building long-term value for our financial services clients. It is how we play our part in building a better working world.

Eurex is the leading European derivatives exchange and – with Eurex Clearing – one of the leading central counterparties globally. Being architects of trusted markets characterised by market liquidity, efficiency and integrity, Eurex provides its customers with innovative solutions to seamlessly manage risk.

On the trading side, Eurex masterminds the most efficient derivatives landscape by pioneering ingenious products and infrastructures, as well as by building ‘smart’ into technology. Eurex is the centre of European equity and equity index markets, offering a global product range, operating the most liquid fixed income markets in Europe and featuring open and low-cost electronic access.

As central counterparty, Eurex Clearing builds trusted relationships with and among market participants, enabling effective risk management and delivering high efficiencies to clients.

FactSet helps the financial community to see more, think bigger, and work better. Our digital platform and enterprise solutions deliver financial data, analytics, and open technology globally. Clients across the buy-side and sell-side as well as wealth managers, private equity firms, and corporations achieve more every day with our comprehensive and connected content, flexible next-generation workflow solutions, and client-centric specialized support. As a member of the S&P 500, we are committed to sustainable growth and have been recognized amongst the Best Places to Work in 2023 by Glassdoor.

From the board room to the engine room, McKinsey & Company Risk & Resilience equips organizations to boldly embrace uncertainty, embed resilience, and enable growth. We drive impact by combining a holistic view of the risk landscape with deep industry and regulatory expertise. By leveraging proprietary solutions, advanced analytics, and proven change management tools, we partner with clients on strategy, implementation and capability building – and everything in between.

Morningstar, Inc. a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with more than USD$193 billion in assets under advisement and management as of Dec. 31, 2018. The company has operations in 27 countries.

http://www.morningstar.com/company/

Morningstar,Inc.是全球目前最主要的投資研究機構之一,業務遍及北美、歐洲、澳洲及亞洲,為個別投資者、投資顧問及機構投資者等專業人士提供專業的產品和服務。Morningstar提供包括管理式投資產品、上市公司、私人資本市場的投資數據資料和環球市場的即時市場數據。Morningstar的投資管理子公司亦有提供投資管理及顧問服務,截至2018年12月31日,Morningstar所管理及給予投資建議的資產約1,930億美元。Morningstar在全球27個國家有發展業務。

http://www.morningstar.com/company/

모닝스타는 북미, 유럽, 호주, 아시아에서 활동하고 있는 독립적인 리서치 회사입니다. 개인투자자, 금융 자문사, 자산 운용사, 퇴직플랜 사업자와 스폰서 및 사모시장의 기관 투자자들을 위하여 다양한 상품과 서비스를 제공하고 있습니다. 모닝스타는 실시간 글로벌 시장 데이터를 비롯하여, 주식, 펀드, ETP, 사모펀드 또는 이와 유사한 상품에 대한 데이터와 리서치 정보를 제공하고 있습니다. 또한 2018년 12월 말기준 1,930억 달러 이상의 자금을 운용하는 자문계열사를 통해 자산관리 서비스도 제공하고 있습니다. 현재 모닝스타는 27개국에 오피스를 운영 중입니다.

http://www.morningstar.com/company/

モーニングスターは独立系大手投資調査会社で、北米、欧州、オーストラリア、アジアの27カ国で拠点を展開しています。同社は、個人投資家、ファイナンシャル・アドバイザー、機関投資家の皆様に対してさまざまなプロダクトやサービスを提供しています。同社が提供している金融商品のデータは株式、投資信託およびその他の投資関連商品や指数を網羅しており、加えてリアルタイム配信する世界各国の市場データとして、外国為替や米国債市場のほか、株式、指数、先物、オプション、コモディティ、貴金属などの系列を有しています。また、投資顧問登録を持つ傘下の子会社を通じて、資産運用ソリューションも提供しており、2018年12月31日現在の助言・運用残高は1,930億ドル以上です。

http://www.morningstar.com/company/

Numerix is the leading provider of innovative capital markets technology applications and real-time intelligence capabilities for trading and risk management. It drives an open fintech-oriented digital financial services market. Numerix is uniquely positioned in the financial services ecosystem to help its users reimagine operations, modernise business processes and capture profitability.

Parameta Solutions is the data and analytics division of TP ICAP Group PLC, the world’s leading wholesale market intermediary, with a portfolio of businesses that provide a number of services, including over-the-counter (OTC) derivatives broking services.

OTC markets cater to innovation and accessibility. They offer a valuable alternative to traditional exchanges, creating a broader investment landscape. Unlike traditional exchanges which have central locations, OTC markets operate electronically through broker-dealer networks. This decentralised approach opens doors to a broader range of investment opportunities and also gives our clients access to a vast pool of the rare and scare data produced in these markets.

We work collaboratively with our clients to deliver this data, and innovative solutions build on this data, to help them create value, optimise capital and manage their risk.

Prometeia is a global provider of consulting services and software solutions focused on Enterprise Risk & Performance Management. Tech proposition, quantitative advisory, training and economic research: this distinctive mix of services has made Prometeia a leading company in Europe for Risk and Wealth management solutions, business consulting and advisory services for institutional investors. Prometeia’s approach to Enterprise Risk Management is based on the development of quantitative models and data science methodologies. The production of highly specialized software applications leverages leading technologies, the knowledge of our matter experts and our ability to respond to growing regulatory demands.

Riskonnect is the leading integrated risk management software solution provider. Our technology empowers organizations with the ability to anticipate, manage, and respond in real-time to strategic and operational risks across the extended enterprise.

Riskonnect’s integrated risk management platform consolidates data, connects risks, and illustrates their relationships. Powering our growing suite of risk management applications is our unique risk-correlation engine that helps our customers understand risk at a level they can’t get anywhere else. It’s no wonder that more organizations choose Riskonnect than any other vendor as their preferred risk management technology provider.

Riskonnect’s integrated risk management platform includes:

- Risk Management Information System

- Claims Administration

- Third-Party Risk Management

- Enterprise Risk Management

- Environmental, Social, Governance

- Internal Audit

- Compliance

- Policy Management

- Project Risk

- Business Continuity & Resilience

- Health & Safety

- Healthcare

To learn more, visit riskonnect.com.

ServiceNow provides cloud-based platforms and solutions that help digitise and unify organisations so they can find smarter, faster and better ways of working, and employees and customers can be more connected, innovative and agile.

S&P Global Market Intelligence integrates financial and industry data, research and news into tools that track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuation and assess credit risk. It offers investment professionals, government agencies, corporations and universities the intelligence essential to make business and financial decisions with conviction.

As a leader in analytics, SAS has more than 40 years of experience helping organisations solve their toughest problems. SAS' unrelenting commitment to innovation enables the financial services to modernise and sustain a competitive edge. SAS provides an integrated, enterprise-wide risk management platform for managing risk in an organisation, from strategic to reputational, operational, financial or compliance-related risk management. Learn more about how SAS is driving innovation and business value for risk and finance professionals at www.sas.com/risk.

Get closer to the market with TraditionData. With over 1 trillion data points across 200+ products and 200k+ instruments going back 15+ years, as well as a global presence with 40+ offices in 30 countries, we provide precision OTC market data and analytics to our customers that is used daily for trading and business decisions.

Enhanced global FX coverage includes deliverable FX forwards, spot crosses, non-deliverable forwards in both outrights and point, IMM fixed settlements dates, as well as starting and ending quarterly turns fixed settlement date instruments.

Our Interest Rate data products, including real-time, intraday, end of day and historical pricing for the global interest rate derivative marketplace is made up of over 19,000 unique instruments from across the entire yield curve, with coverage across 34 currencies. We also offer a market-leading SOFR Indicative Rate Service, the first true intraday “day-ahead” insight to the next day’s SOFR rate.

TraditionData is part of Tradition (Compagnie Financière Tradition S.A. (SWX: CFT)), one of the world’s largest interdealer brokers in over-the-counter financial and commodity products. Tradition’s long history of managing pricing liquidity and trade execution across multiple asset classes in vanilla and complex products in primary and emerging markets enables us to access prices in many of the world’s most dynamic and traditionally opaque markets.

Website: www.traditiondata.com/

About Wolters Kluwer, Finance, Risk & Reporting

Wolters Kluwer’s Finance, Risk and Reporting (FRR) business is a market leader in the provision of integrated regulatory compliance and reporting solutions, supporting regulated financial institutions in meeting their obligations to external regulator and their own board of directors.

It is part of Wolters Kluwer N.V. (AEX: WKL), a global leader in information services and solutions for professionals in the health, tax and accounting, risk and compliance, finance and legal sectors. Wolters Kluwer reported 2018 annual revenues of €4.3 billion. The company, headquartered in Alphen aan den Rijn, the Netherlands, serves customers in over 180 countries, maintains operations in over 40 countries and employs 19,000 people worldwide. For more information: www.wolterskluwerfs.com

Enhance your brand at the industry's most credible event

Explore unparalleled opportunities at Risk Live events, where you can connect with influential decision-makers and top-tier risk professionals. Participate in meaningful discussions and boost lead generation while expanding your network. Join us to not only enhance your thought leadership but also to foster strategic partnerships.

With different content-driven stages, the Risk Live events series provides an extensive overview of the risk management landscape. Our audience grapples with challenges ranging from digital transformation and data management to cyber threats, regulatory changes, and AI integration. Showcase your solutions to empower them in overcoming these obstacles.

In 2024, the Risk Live events will take place in eight different countries, offering a global perspective on the risk ecosystem. Don't miss this opportunity to meet a senior global audience and position your brand at the forefront of the evolving risk landscape.

Why sponsor Risk Live

Connect with senior risk professionals

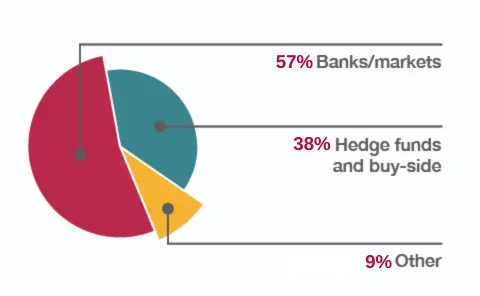

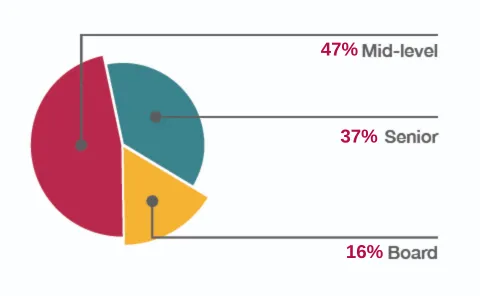

Our engaged attendees, senior decision-makers, come from diverse financial institutions, such as banks, asset managers, insurers, and regulators.

Increase brand visibility

Unparalleled networking with potential clients. Elevate your brand visibility online, in marketing materials, and during live sessions. Leverage Risk.net’s event app for seamless networking and collaboration opportunities.

Participate in enriching discussions

Sponsors can showcase their expertise and thought leadership on key industry topics through speaking opportunities and targeted content.

High return on investment

Our sponsorship packages offer maximum value for your investment, with a range of benefits tailored to meet your specific needs and objectives.

Our audience

Industry breakdown

Seniority breakdown

Ways to get involved

Thought leadership

Tech demo

Brand visibility

Your sponsorship will feature prominently throughout the event, including online, in marketing materials and during the event exhibition floor and live sessions.

Media partners

Chartis Research is the leading provider of research and analysis on the global market for risk technology. Our goal is to support companies as they drive business performance through improved risk management, corporate governance and compliance. We also help clients make informed technology and business decisions by providing in-depth analysis and advice on virtually all aspects of risk technology.

Chartis is focused solely on risk and compliance technology, giving us a significant advantage over other market analysts. Our analysts and advisors have decades of hands-on experience of implementing and developing risk management systems and programs for Fortune 500 companies and leading consulting houses.

The Global Association of Risk Professionals is a non-partisan, not-for-profit membership organization. GARP offers risk certification — the Financial Risk Manager (FRM®) and Energy Risk Professional (ERP®) — and educational programs for professionals at financial institutions, government agencies, central banks, academia and corporations. Through the GARP Benchmarking Initiative and GARP Risk Institute, GARP sponsors research in risk management and promotes collaboration among practitioners, academics and regulators to promote a culture of risk awareness. Founded in 1996, governed by a Board of Trustees, GARP is headquartered in Jersey City, NJ, with offices in London, Washington, D.C. and Beijing. GARP sets the global standard in professional certification with the Financial Risk Manager (FRM®) and Energy Risk Professional (ERP®) certifications. These programs are rigorous and very well respected across the globe. By demonstrating expertise and commitment to better risk management practices, Certified FRMs and ERPs stand apart in their respective organizations. For additional information, visit garp.org.

Risk Books has been a world leader in specialist books on risk management and the financial markets for over 20 years. Risk Books is proud to be a niche publisher that has quality as its top priority.

Our mission is to produce books that truly add value by delivering the very best information on our specialist subjects. And with more than 180 different titles currently in print, Risk Books covers a wide range of technical subjects for academics, practitioners, investors and corporate users - ranging from derivatives, hedge funds, quant analysis, credit, regulatory issues and operational risk to the energy, insurance and currency markets – with books for experts and scholars alike.

Designed and delivered by industry experts and thought leaders, Risk Learning covers a range of topics across risk management, derivatives and complex financial markets. Risk Learning courses reflect the latest industry developments, regulatory updates and best practices. Access the most up-to-date knowledge and practical insights to prepare yourself, your team and your organisation for real-world challenges.

Risk Journals deliver academically rigorous, practitioner-focused content and resources for the rapidly evolving discipline of financial risk management.

Each quarter, Risk Journals provide peer-reviewed research and technical papers, delivered to a global audience in print and online. The Risk Journals portfolio has been serving, broad and international readership communities that bridge academia and industry for over 25 years. The mission of Risk Journals is to equip readers with the tools to fulfil their professional potential.

Risk Journals publishes original and innovative papers, ensuring subscribers are kept up-to-date with the ever-changing complexity behind the science of risk management.

Contact us

Sponsorship enquiries

Antony Chambers

Publisher, Risk.net/FX Markets/WatersTechnology