Partner Opportunities

Sponsorship

Enhance your brand at the industry's most credible event

Experience unparalleled opportunities at Risk Live. Connect with senior decision-makers and leading risk professionals, engage in enriching discussions and drive lead generation. Join us to expand your network, establish thought leadership and foster strategic partnerships.

Spanning eight streams across five content-driven stages, Risk Live North America offers a comprehensive view of the risk management landscape. Our audience tackles challenges such as digital transformation, data management, cyber threats, regulatory changes and artificial intelligence integration. Showcase your solutions to empower them in overcoming these hurdles.

Become a speaker

Send us your paper and we will get in contact with you.

Partnership pack

Download the media pack to see how you can get involved in Risk Live 2024.

Delegate list download

Download Risk Live 2023 delegate snapshot. See who you could meet and spark partnerships with.

How Risk Live works for you:

Branding

- Status of Sponsor across all marketing and during live event

- Pre-event: logo and profile published on event website & digital advertising on Risk.net

- Logo and profile published on event signage, event website and virtual platform

Re-connect and network in person

- Connect with senior decision makers and influencers

- Position your subject matter expert as a speaker

- Elevate brand awareness as our networking drinks reception sponsor

- Engage our audience through an interactive briefing

- Create evergreen content by filming an interview of your subject matter expert at the event

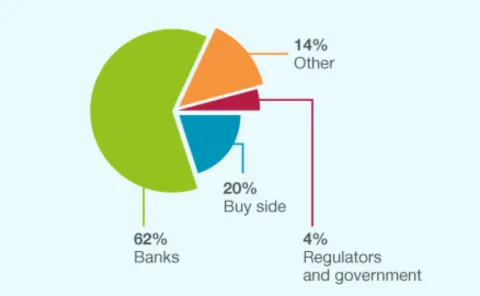

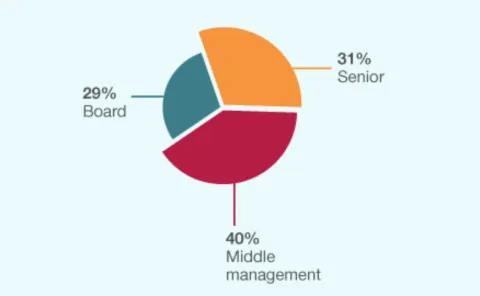

Our audience

Industry breakdown

Seniority breakdown

Previous sponsors

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration.

Milliman is among the world’s largest providers of actuarial, risk management, and related technology and data solutions. With over 60 offices around the globe, our consulting and advanced analytics capabilities encompass the fields of healthcare, property and casualty insurance, life insurance, financial services, and employee benefits. Our breadth of expertise and data solutions provide insight into the interplay between physical, health, and economic risks, as well as the ability to communicate those risks and inform key decisions for governments, communities, and businesses around the world.

Founded by a group of industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across trading desks, risk, and compliance. That is why we pioneered the use of high-performance analytics in finance, helping the largest investment banks, asset managers and hedge funds make better decisions, explain results with confidence, and simulate the impact of their decisions.

Our mission is to deliver train-of-thought analysis on terabytes of data in the most cost-effective way so our customers can explain their results with confidence and model the scenarios that will optimize their business. We are a pure player specializing in risk data analytics for one of the fastest moving and most regulated industries with a presence in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris, and Frankfurt.

ActiveViam are also the proud winners of the Best use of cloud and FRTB product of the year at the Risk Market Technology Awards 2024.

For more information please visit: www.activeviam.com

We empower institutions in financial markets to seize opportunities amidst uncertainty by delivering unparalleled accuracy, transparency, and innovation through our industry-leading expertise in quantitative analytics and cutting-edge technology.

S&P Global Market Intelligence integrates financial and industry data, research and news into tools that track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuation and assess credit risk. It offers investment professionals, government agencies, corporations and universities the intelligence essential to make business and financial decisions with conviction.

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better and faster decisions. Its risk expertise, expansive information resources and innovative application of technology help its clients confidently navigate an evolving marketplace. Moody’s Analytics offers industry-leading and award-winning solutions, made up of research, data, software and professional services.

Clarity AI is a sustainability technology platform that uses machine learning and big data to deliver environmental and social insights to investors, organizations, and consumers. Clarity AI’s capabilities are an essential tool for end-to-end sustainability analysis related to investing, corporate research, benchmarking, consumer ecommerce, and regulatory reporting. As of January 2023, Clarity AI’s platform analyzes more than 70,000 companies, 360,000 funds, 198 countries, and 199 local governments, which represents the broadest data coverage in the market with up to 13 times more than other leading players. One way Clarity AI delivers on its mission to bring societal impact to markets is by ensuring its capabilities are delivered directly into clients' workflows through integrations with partners like BlackRock - Aladdin, Refinitiv an LSEG business, BNP Manaos, Allfunds, and Simcorp. Additionally, Clarity AI's sustainability insights reach more than 150 million consumers across more than 400,000 merchants on the Klarna platform. Clarity AI has offices in North America, Europe, and the Middle East, and its client network manages tens of trillions in assets for companies like Invesco, Nordea, PGIM, Santander, Wellington, and BNP Paribas. clarity.ai

FactSet helps the financial community to see more, think bigger, and work better. Our digital platform and enterprise solutions deliver financial data, analytics, and open technology globally. Clients across the buy-side and sell-side as well as wealth managers, private equity firms, and corporations achieve more every day with our comprehensive and connected content, flexible next-generation workflow solutions, and client-centric specialized support. As a member of the S&P 500, we are committed to sustainable growth and have been recognized amongst the Best Places to Work in 2023 by Glassdoor.

Coherent provides easy-to-use data pipelines that allow back-end developers to build data back-ends, including machine learning pipelines and indexers. Its datasets provide data points for indexing and creating models

KWA Analytics is a consultancy with a focus on and experience in implementing trading, risk and treasury management solutions. It is experienced in implementations, upgrades and solution architecture across a range of organisations, and has established itself as a trusted implementation consulting services provider.

SAS is a global leader in AI and analytics software, including industry-specific solutions. SAS helps organizations transform data into trusted decisions faster by providing knowledge in the moments that matter. SAS helps clients across industries address their most critical and complex analytical challenges through SAS Viya, our cloud-native AI, analytic and data management platform.

From helping our customers fight fraud and mitigate risks through our fraud, anti-money laundering, security intelligence and risk management solutions, as well as helping drive engagement through our customer intelligence solutions, SAS delivers innovative solutions to enable our customers achieve greater productivity, performance and trustworthiness.

MSCI is a leading provider of critical decision-support tools and services for the global investment community. With over 50 years' expertise in research, data and technology, MSCI powers better investment decisions by enabling clients to understand and analyse key drivers of risk and return, and to confidently build more effective portfolios. MSCI creates industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

Quantifi is a provider of risk, analytics and trading solutions. Its award-winning suite of integrated pre- and post-trade solutions allow market participants to better value, trade and risk manage their exposures. Founded in 2002, Quantifi is trusted by the world’s most sophisticated financial institutions, including five of the six largest global banks, two of the three largest asset managers, leading hedge funds, insurance companies, pension funds and other institutions across 40 countries. By applying the latest technology innovations, Quantifi provides new levels of usability, flexibility, and integration. This translates into dramatically lower time to market, lower total cost of ownership and significant improvements in operational efficiency, allowing clients to focus on their core business.

ServiceNow makes the world work better for everyone. Our cloud-based intelligent platform helps digitise and unify organisations to drive smarter, faster ways to address evolving risks, vulnerabilities, and compliance challenges. Power your resilient enterprise with risk-informed decisions embedded in daily work. Connect the business, security, and IT to manage risk and resilience in real time.

As society redefines risk and opportunity, OneTrust empowers tomorrow’s leaders to succeed through trust and impact with the Trust Intelligence Platform. The market-defining Trust Intelligence Platform from OneTrust connects privacy, GRC, ethics, and ESG teams, data, and processes, so all companies can collaborate seamlessly and put trust at the center of their operations and culture by unlocking their value and potential to thrive by doing what’s good for people and the planet.

About Murex

Murex provides enterprise-wide, cross-asset financial technology solutions to sell-side and buy-side capital markets players. With more than 60,000 daily users in 65 countries, its cross-function platform, MX.3, supports trading, treasury, risk, post-trade operations, as well as end-to-end investment management operations for private and public assets. This helps clients better meet regulatory requirements, manage enterprise-wide risk, and control IT costs. Learn more at www.murex.com.

OpenGamma is a derivatives analytics firm with expertise in over-the-counter and exchange-traded derivatives margin methodologies, backed by CME, JSCC, Accel and Dawn. It is trusted by large and sophisticated global banks, trading firms and fund managers, with thousands of users depending on its analytics.

Eurex is the leading European derivatives exchange and – with Eurex Clearing – one of the leading central counterparties globally. Being architects of trusted markets characterised by market liquidity, efficiency and integrity, Eurex provides its customers with innovative solutions to seamlessly manage risk.

On the trading side, Eurex masterminds the most efficient derivatives landscape by pioneering ingenious products and infrastructures, as well as by building ‘smart’ into technology. Eurex is the centre of European equity and equity index markets, offering a global product range, operating the most liquid fixed income markets in Europe and featuring open and low-cost electronic access.

As central counterparty, Eurex Clearing builds trusted relationships with and among market participants, enabling effective risk management and delivering high efficiencies to clients.

Risk Live is one of the few events where banks and the buy side come together to thrash out the issues shaping the future of finance. The topics up for discussion this year look to be right on the money, from the ongoing challenge of alpha generation to the technologies the industry must adopt to succeed.

Andrés Choussy, CEO, Taiana